Understanding the recent tech selloff, and what it means for your portfolio

March Madness Begins…

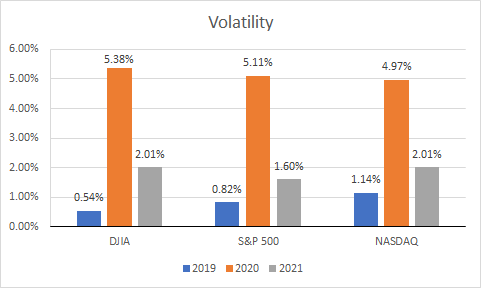

The common narrative across social media and news channels talks about the volatility of this years month of March. While the hype makes us believe that March madness has arrived early, a brief look at the past tells us that the markets were relatively more stable this year as compared to 2020, and slightly more volatile than 2019. (see below)

Without going into a statistics 101, looking at historical data I can say that this year has been relatively stable as compared to last year and that the high volatility of NASDAQ and DJIA is explained by investors exiting tech stocks (NASDAQ) and taking positions in industrials (DJIA). Also notice the similarity of the volatility between DJIA and NASDAQ, which further hints at capital flowing out of tech stocks and into more traditional companies.

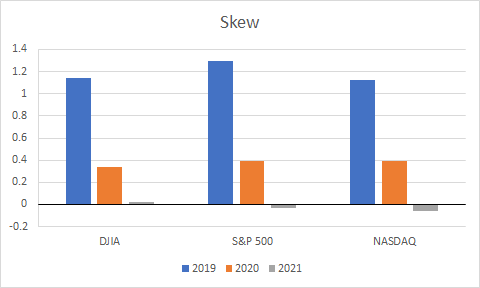

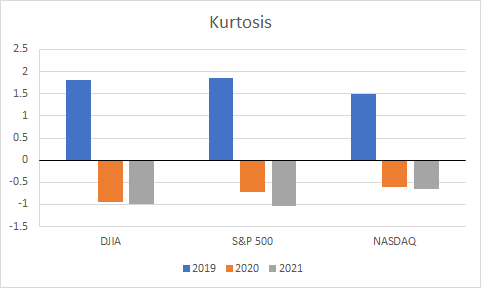

Lastly, the low kurtosis and positively skewed DJIA, which comprises of industrial stocks, is the only index which has seen extreme returns which are positive, unlike the S&P 500 and tech loaded NASDAQ.

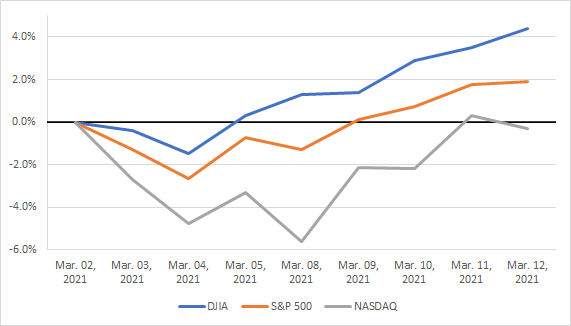

Thus we can see from the graph below that considering only the opening day of March and Friday the 12th, tech stocks have had a flat month.

Why the Shift from the New to the Old ?

Common Logic

The simple logic of investors moving away from the new age tech companies is that with the improving prospects of the economy, people are expecting cities to open up and people to spend time in hotels, take vacations and do normal things — which will give a huge boost to the earnings of traditional companies.

Thus one way to look at it is that people are pricing in the future expected earnings of traditional companies (post lockdown) by investing in these companies’ stocks and thus boosting their price.

Academically Speaking…

For those interested in the more academic aspects of the situation, we need to revisit the concept of time value of money, which stipulates that every action has an opportunity cost which may be measured by interest rates. Simply put, if the best savings rate in a bank is 5% for $50. The opportunity cost of spending the $50 on a video game will be 5%. This opportunity cost is also called as the discount rate, because future cash generated will be discounted (divided) by this rate to gauge the worth of the same money if we had it today.

Free Cash Flows

This brings us to the basics of how stocks of companies are valued. The basic rationale is that investors try and forecast the free cash flow (FCF) that the company will generate in the future and then discount the cash flows to the present date. All the cash flows are then summed up and divided by the shares outstanding to try and estimate a fair value for a share of the company.

As each company has taken on debt at different levels, time, and duration the discount rate for every company is different. At present, a simple form of calculating this rate is using the CAPM formula. We can see that the final discount rate is also affected with the treasury rate (aka risk free rate). Thus a higher rate is often likely to lead to higher discount rates.

NPV — Net Present Value

I previously mentioned how the future forecasted cash flows are discounted to the present day and then summed up. This final value is known as the Net Present Value or NPV. A higher NPV usually indicates a more efficient outlet for allocation of capital. However, the NPV is not only affected by the amount of cash flows, but also by the timing of the cash flows.

Now we know that most tech companies are still growing and are in the nascent stages of their business cycle. A large number of the companies are not breaking even, but are expected to return huge profits after a few years. These expectations are priced in to the stocks leading to high P/E ratios.

Comparatively, traditional stocks are more mature with low growth and stable earnings and profits. To understand better, let us consider two fictional companies.

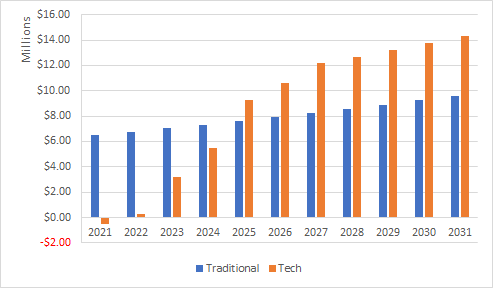

We can see that the traditional company is expected to generate cash flows of $6M starting 2021 with stable growth over the next ten years. On the other hand, the tech company, which is in loss in 2021 experiences rapid growth over the next few years eventually out-earning the traditional company by 2025.

Now in such a scenario, the time value of money concept, on which the fundamentals of stock valuation is based, stipulates that $100 today is worth more than $100 tomorrow. We also know that an increase in treasury rates may lead to an increase in the discount rates. Thus at different rates, future cash flows may become less valuable than they otherwise were.

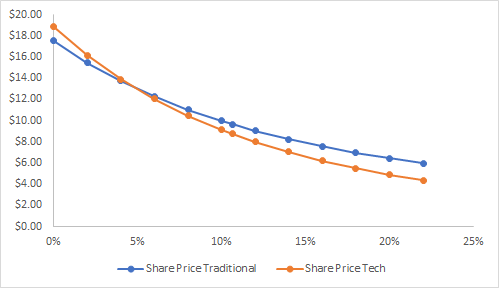

Assuming both companies to have 5 million shares outstanding, we can see from the image above that as the discount rate increases the value of a single tech company share begins to reach a lower price point than that of a traditional company. Thus, a secondary explanation for the dip in tech stocks, may be that investors are also shifting out of this sector owing to higher treasury rates which could make borrowing for tech companies more costly, and drive up the discount rate. Lastly, investors may be interpreting higher treasury rates as indications that the economy is back on its feet (and so, no more stimulus!!).

Beware the ‘Ides of March’!?

In one word — no. Unlike Ceasar’s untimely death, opening up of the economy is not going to make the (already non-existent) expected cash flows of tech companies vanish. Whilst I certainly believe that the bull run is over, I also feel that the time is ripe to pick up stocks of tech companies at the lower price points. One interpretation of the NASDAQ index over the last week may be that many people snapped up tech stocks at low prices on March 08th (see graph above) leading the index the recover its losses.

Thus, whether you like it or not tech is here to stay and is going to percolate our lives with the passage of time. Perhaps this is one of the key reasons why Cathie Wood remains bullish on the markets, Tesla and bitcoin.

The Final Take

My personal takeaway on the present situation is to wait and buy the dip. As I expect the next few weeks and months to be choppy, the criticality of research, and due diligence prior investing in a company is heightened. I strongly feel that this is a good time to cherry pick tech companies whose technologies are going to be big, and still ride high on the industrials crest!

Note — This is not investment advice but merely the opinion of the author and is for general and informational purposes only. Please undertake your own research and diligence before making any investment decisions. Investing is a risky business where caution is warranted. The author cannot guarantee any profits or losses and is not a registered investment advisor or broker.