The onset of covid-19 has posed a unique challenge various businesses across the world. While we are presently amidst what seems to be the second wave of covid-19, multiple industries have begun to indicate signs of recovery – not in the least the Tech sector owing to their WFH friendliness.

I had previously written an article wherein I tried to forecast the intrinsic share price Air Canada. Revisiting my previous findings and looking and new data released, have indicated to me that the transportation and especially the airline industry is already on track to recovery.

Data Collection and Rationale

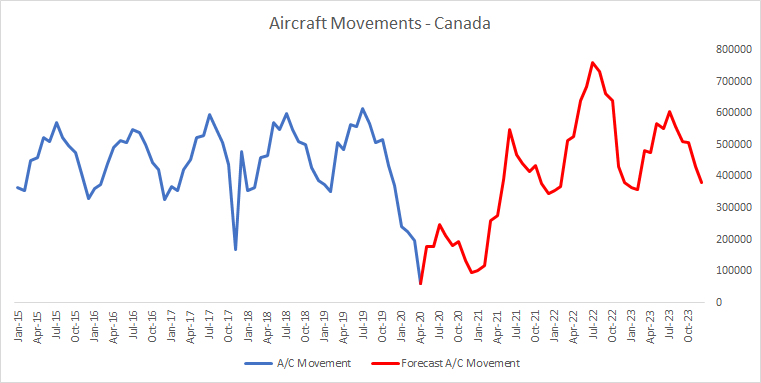

I collected data from Stat Canada about aircraft movement from January 2015 (major airports) up to April 2020 and compiled it. Subsequently, I created an index linked to the aircraft movements in July 2018 as it was the highest number — this would allow me to gauge the level of aircraft movements in the future with those in a bullish market.

First, I created a monthly average for all the twelve months in a year and used that to create a seasonality index for every month (i.e. Monthly Average of a Month / Average of all Months). I then calculated the average aircraft moments for every month and (index values) and check the difference of those values with those of ‘covid’ the affected months of Jan — May 2020. The index value of April 2020 was 10 which correlates with reports of airline cutting between 85–90% of their capacity for the covid affected months.

Further, I assumed that the effects of covid and the international travel restrictions and lock-downs will commence to open up — at least for businesses and other important drivers of economy by end June 2020. I graduated the index difference downward by 2.5 points to cater to conservative growth estimates considering that aircraft will have to undergo maintenance checks and pilots will have to regain their ‘currency’ before being pressed into service.

My intention was to forecast the values up to the completion of a stabilized cycle of business as this would indicate the normalization of aircraft movements.

I found that aircraft movements reach ‘pre-covid’ levels in May 2022 and stabilize by the end of December 2023.

Update – Actual aircraft movements in Canada are higher than my forecasts for the months from April upto July by a minimum of 20% which indicate that the industry is slowly propping itself back up.

Airline stocks (Air Canada) Undervalued ?

Extrapolating from the aircraft movements, I assumed an average revenue growth of approximately 16% over the next five years for Air Canada.

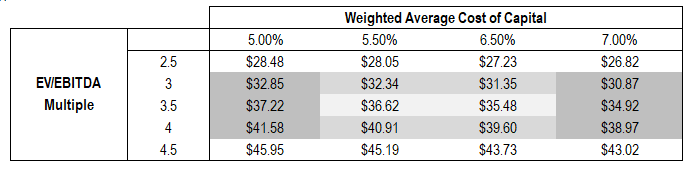

Assuming zero cash balance because of the ongoing pandemic and the high probabilities of having to use capital for servicing debt and various unforeseen obligations, the intrinsic value of Air Canada stock is $37.14, which is a premium of 119% on the current market price of $16.93.

EV/EBITDA multiple has been considered as 3.6x for the purpose of the valuation. Brief sensitivity analysis gives us the following results

Can the Past Predict the Future? Railways in the 1920s

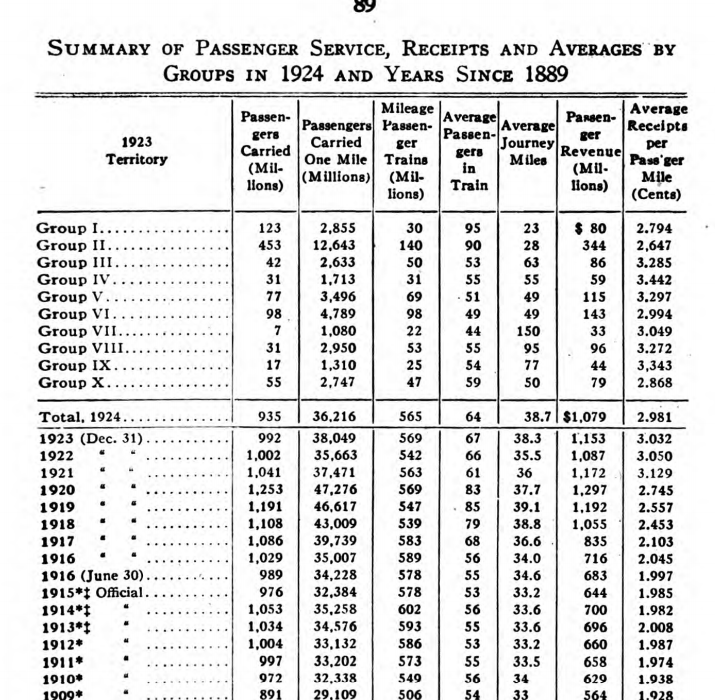

Data from the Office of Railway News and Statistics for the years 1916 – 1924 revealed interesting characteristics to me. I specifically chose this timeline as it encompasses the period of the 1918 flu with adequate buffer both – before and after.

The number of PAX carried by the railways drastically increased from the late 19th century and stabilizes approximately around 1921 (see below) with a slight taper at 1923.

Interestingly enough the railways were bleeding money, and YoY revenue growth (because of 50% increase in ticket prices) was not enough to offset the increasing wages of railway employees and tax rates. Perhaps the expansion of the railways in the early 1920s was prophetic as a case for cost-push inflation may be argued for, which eventually led to a slight dip in the economy before further stabilization after 1924.

However, it is relevant to note that the effects of the flu were essentially faced by businesses only in the September and October of 1918. Additionally, the means of data collection may be questioned because various historical records paint contrarian views of what was actually happening on the ground. Lastly, owing to the war efforts a large number of businesses were taken over by the government (including railways). The sum and substance of all these facts is that the above data needs to be treated with care and perhaps trepidation.

To me two things stand out, the first is that people effectively begin to travel as soon as they think it possible to do so. Second, and more importantly, the prevailing bias of the public vis-à-vis the economy usually lags from the actual numbers on the ground (or air).

Interpretation

Economy & Future of Commercial Airlines — Assuming that aircraft movements represent the health of the aviation industry (which in turn represents the health of the economy), as most travel is undertaken via discretionary finances, it seems that the economy will stabilize its growth during Q3 of 2021 and will touch pre-covid levels by Q2/Q3 of 2022 before completely stabilizing in Q1 2024. Interestingly, IATA — an association of global airlines has predicted that passenger demand will recover only by 2024, somewhat similar to my model with a December 2023 forecast. I personally believe and will not be surprised if the airline industry recovers earlier than expected. It is a fairly resilient industry which has overcome headwinds in the past (notably from terrorist activities). Further, the present deflationary effect on ticket prices is likely to dampen by mid 2021. I expect ticket prices to regain historical levels as airlines reconfigure themselves operationally and structurally.

Airline Industry — It is clear that the airline industry will take the best part of three years to recover. Airlines are already taking action to reconfigure their fleet and staff. Refinancing outstanding debts and bringing in newer aircraft will essentially reduce operational expenses in the long term. Additionally, unless placed on furlough the airlines are likely to have a large pool of aircrew and staff to select from once the channels for travel begin to reopen (especially internationally).

Air Canada Stock — The stocks of Air Canada are grossly undervalued as per the last closing price ($16.93 on October 23 2020) when compared to the average of the intrinsic value arrived via DCF and Graham method. However, the risk from an inflationary environment post-covid 19 leading to more losses for airlines might be reflected in the depressed price of the Air Canada stock at this moment.

As a high risk, high uncertainty stock in a cyclical industry, I feel that it would be prudent to allocate a chunk of the portfolio to airline stocks for young investors with a time horizon of 3 – 5 years.

I want to clarify that all views/opinions are my own and should not be construed as investment advise or advise of any other form. Read the original article here