A quick and general recap of my thoughts on the markets, as compared to my general ramblings. Includes my general thoughts on the stock indices, earnings trends of companies at a micro level, strength in CPG companies along with a general comment on Figs Inc. of which I remain an optimistic yet cautious speculator

General Market Musings

It has been a while since I’ve posted on about my thoughts what with the current situation with the Roblox ban of the Mall Massacre plans, along with the hyped-up news about an impending regime change in Iran, if the country doesn’t manage to heed of American pressure on its O&G as well as nuclear program.

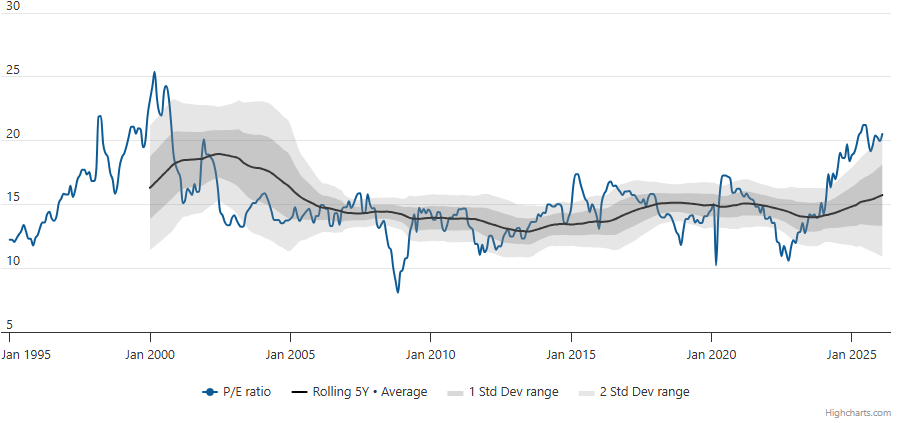

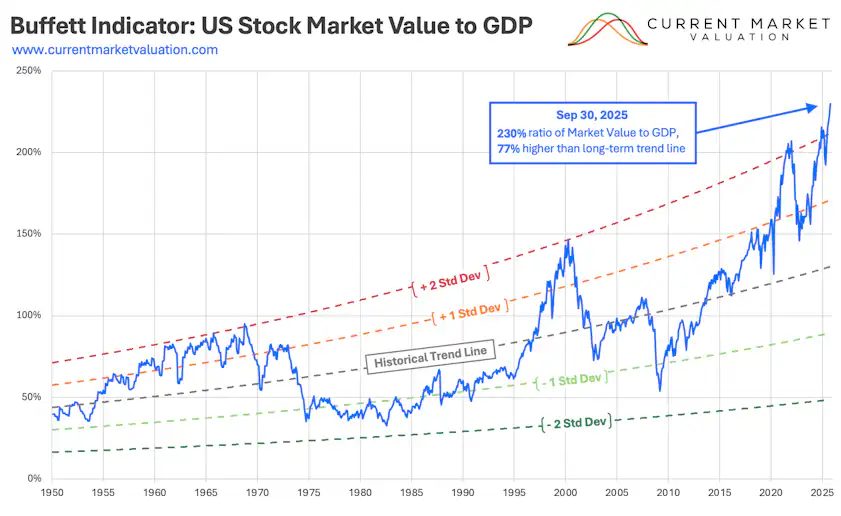

It has been my observation that market levels have tended to remain slightly elevated as compared to historic precedents if one is to utilize the standard charts of many a practitioner such as those of the PE, and the Buffet indicator viewed along with historical standard deviations from the mean history. See below for the S&P TSX along with a 5year rolling mean.

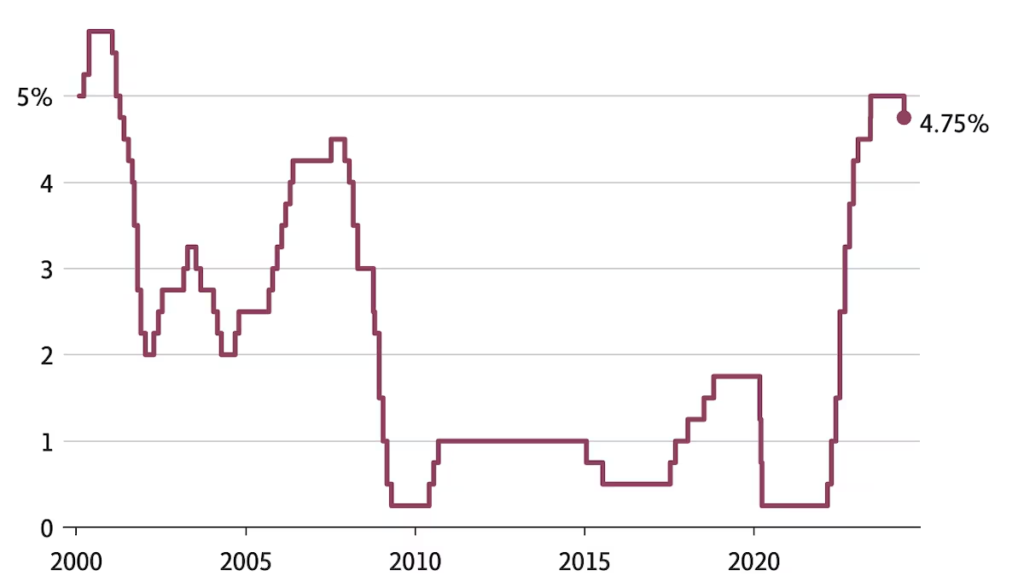

With the historical mean hovering near-about the 15-17x range, and the S&P 500 trading at similar highs compared with historical precedents there must in my opinion reside cautious pessimism in the minds of most investors. The Buffett Indicator Valuation model also indicates that the markets are a touch overvalued albeit not as frothy as they were post the “pull-forward COVID-19 recession” as well as the ensuing recession which followed around 2022-2023. It would bode well to keep in mind that a large part of the froth was a resultant of the markets not knowing which way the Key interest rates would move, as well as the confusion and the uncertainty that the COVID-19 pandemic had thrown into the models of many an economist as well as market forecasters.

Given that we are clearly not in value territory, it is my opinion that any purchases of marketable securities need to be made in a very cautious and prudent manner which fundamental valuation as the bedrock of making any investment in the current markets for the forthcoming 9 months to 1 year timeline.

Forward View

Given that the BoC has held the Key Interest rate at 2.25%, I believe that the Fed is likely going to hold on to the current interest rates or move them up a notch so as to ensure that the PE or the earnings multiple compresses back to historically manageable levels. It is interesting to note that post the Tech Bubble of the “nearly noughties” (nearly because the GFC played spoilsport to an era of general market boom and very less gloom from 2001 onwards), the decision makers in the government, also held rates steady so as to compress the PE and therefore the valuations of companies.

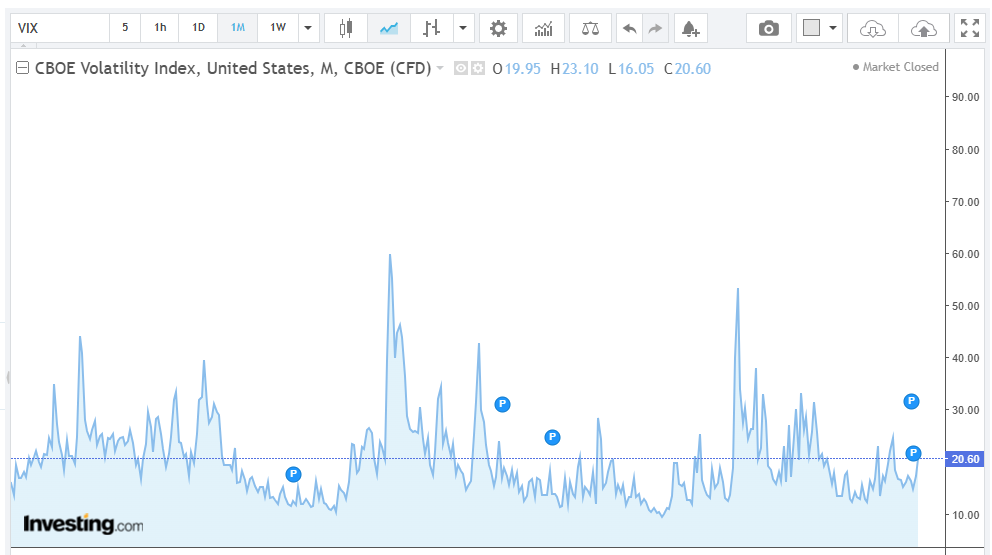

Speaking of market froth, the reason I speculate that we need to be cautious with any investments being made is simply owing to the lower volatility of the current markets throwing up far fewer opportunities to purchase marketable securities at an attractive price. Trend might be friend, but so is volatility for the ultimate value investor. Additional research from JP Morgan reflects news that is likely to make all goldbugs happy – that the price of Gold is likely going to be higher in the next two – three years. I do not have any specific view on this topic about gold price prediction other than, it will likely go higher in the next few years from today’s price moderately as a safe haven purchase and to maintain purchasing or parity power.

I have also noticed a couple of CPG and retail stocks have been on a tear, with some investors from QV Investors stable mentioning that a multiples expansion of the PE ratio has contributed to the higher prices of equities in the CPG space, whilst talking about knowing when to hold and fold stocks. One of the retail stocks that I have been watching with vested interests over the last few years has been Figs Inc…

Figs Inc. at Fair Value – Trim / Hold

I previously wrote about Figs towards the end of 2024 on Seeking Alpha. The company was subject to a takeout offer in the early $6 range, and it was then my belief that the stock had a fair value of $11.36. Whilst I did not expect the price to run up so quickly, I remain positive on the company’s future – what with the recent announcements of opening up three more brick and mortar stores as well as making a harder push into other international markets. However, pushing into newer markets and opening stores dictates capital outlays by ways of SG&A as well as other operational costs which will add up in the near future.

I strongly believe that if the company can use this momentum, with opening new stores, and thereafter begin a push into leisure activewear – similar to what lululemon has undertaken, we might have a long term winner of a stock amidst us. It must be mentioned that during its early days, lululemon was an attractive purchase even at PEs of 40-45x something which other CPG stocks such as Colgate-Palmolive have also shorn with pride during the late 70s and 80s (read Terry Smith’s book for the same).

Given that the current Forward PE, EV / Revenue and P/S are all at extended levels 73x, 2.6x, 3.1x by historical or current margins, and that new brick and mortar shops are going to open, we are going to see more debt tacked on to the $54m that currently sits on the books. Whilst this will ensure an organic compression of the EV multiple along with growing revenues, I remain cautious on the stock until the PE and P/S ratios either fall back to 50-60x on a forward basis (and 1-1.8x P/S). However, given that it is difficult to time the decisions, if and when, the company decides to venture a foray into athleisure wear or other such avenues, I believe it may be the right time to trim any holdings of the stock whilst still maintaining a core position in the company.

Given the Illiquid options which trade for this name, I would not want to speculate on any activity which eschew the equity markets as far as Figs Inc. is considered. I presently maintain my fair value of $11.36. With a current market price of $10.30 and trading at only a 9% discount, I believe it is prudent to trim my holdings especially in light of the other market conditions as mentioned.

The Final Take

There still exist opportunities in the markets, but investors have to avoid fastest finger and a happy trigger before purchasing any new investments without doing the fundamental analysis involved. Furthermore, given that most of the G5 and G7 don’t have presidential elections until near 2029 (other than France), one may expect the Fed(s) to do the prudent thing and keep the rates high for longer and potentially hike them up as well.

Another name I am considering is Yellowpages (Y CN Equity). A steady stock in a declining industry, the dividend of this company will make for an attractive investment in a mixed book, if it would be possible to isolate the yield, so as to maintain a core foothold given the steady AND predictable cashflows.

Feature image set to indicate “A View from the Top” or rather a brief / birds eye view on the markets today